Carbon capture, utilization, and storage (CCUS) has been highlighted by Canada’s federal government as one of the key technology areas for achieving global climate and energy goals by 2050. Existing buildings can play a huge part in this strategy if given the chance.

In 2021 the federal government proposed an investment tax credit for businesses that incur eligible related expenses for carbon capture, utilization, and storage. Then, in 2022 the federal government announced an updated version that would be refundable and available to businesses that incur eligible expenses starting January 1, 2022. The tax credit would be available to cover the cost of purchasing and installing qualified equipment on eligible CCUS projects, where the captured CO2 is employed for an appropriate use. CCUS is seen by the government as an essential method for decarbonizing heavy industries, establishing low-carbon dispatchable power, creating low-carbon hydrogen production, producing cleaner oil and gas, and more. Furthermore, the International Energy Agency has made clear that net-zero emissions goals will become virtually impossible to meet without CCUS.

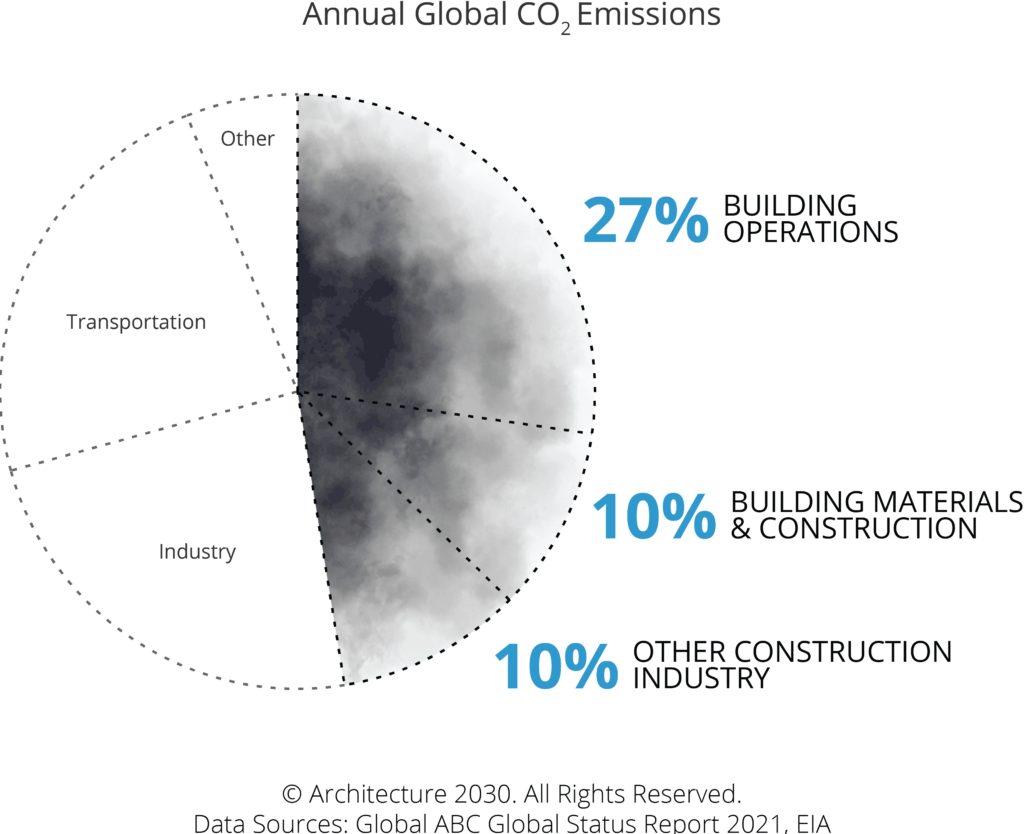

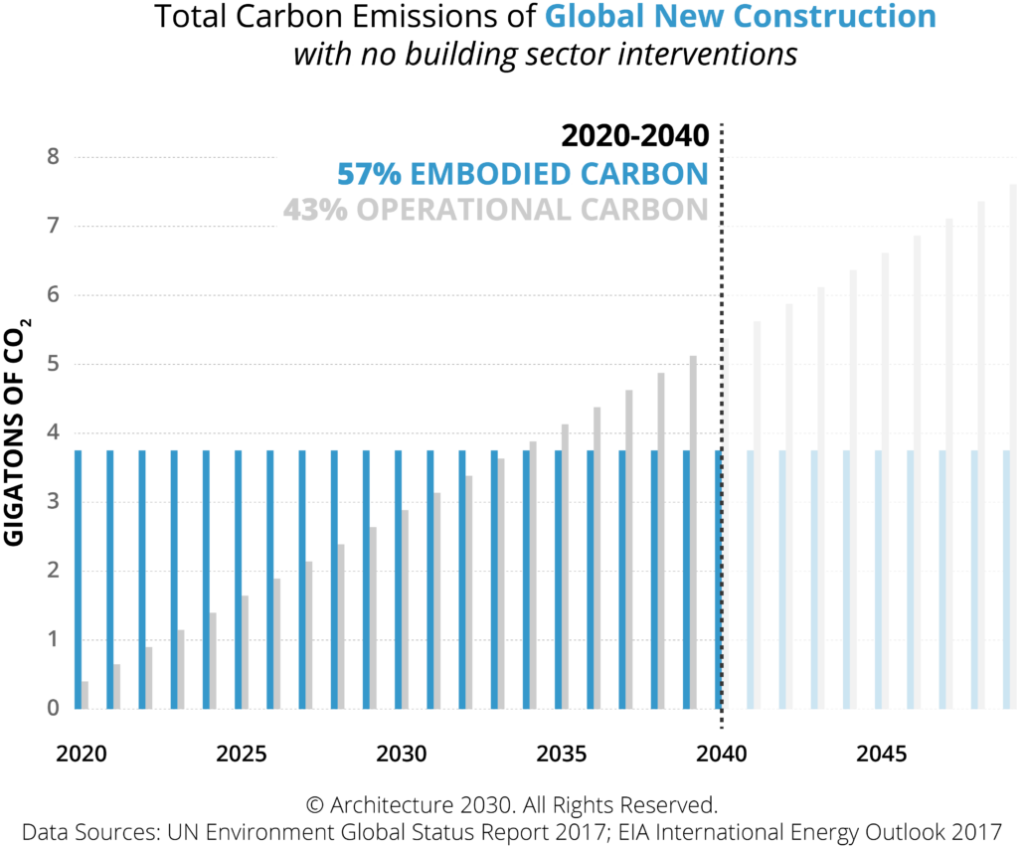

On a related note, MTBA suggests that a tax credit for older buildings be proposed by the federal government. Both for carbon “captured” in buildings 40 years of age and older, and “avoided” in buildings that are reused instead of demolished. The tax credit could increase in amount for higher percentages of reused or repaired material in eligible projects. Also, it could increase for improvements in building performance. Existing buildings inherently function as carbon sinks and their reuse avoids the substantial amounts of carbon emissions and resource extraction that comes with new construction. A tax credit would help incentivize the reuse of existing buildings in a country that, over the past 30 years, has lost 23 percent of its historic building stock in urban areas, and 21 percent in rural areas.

The implementation of a federal tax credit for older, existing buildings is key for achieving CCUS targets, and decelerating a rate of destruction that is disturbing both in terms of lost heritage and in increased environmental waste. For more information on why tax credits for existing buildings is beneficial for social, economical, and environmental purposes please see: Property Values and Taxes Canada’s Historic Places and Carbon capture, utilization and storage strategy (nrcan.gc.ca)

Examples of existing tax credits in Canada that promote the conservation of existing buildings can be seen in Western Canadian cities such as Winnipeg, Edmonton, and Victoria. Incentives include refunding property taxes to cover the costs of eligible work up to 50%, giving lump sums for work done, and tax exemptions over a course of 5 to 10 years. These tax credits have also been shown to be successful, with higher property values, the stimulation of local economies, and the conservation of important historic places.